Tax residency certificate

Tax residency certificate is backordered and will ship as soon as it is back in stock.

Couldn't load pickup availability

Delivery times

Delivery times

Important!!! To avoid misunderstandings, we recommend that you carefully read the delivery times indicated in the product description.

Confidentiality

Confidentiality

Our philosophy is based on a total commitment to confidentiality. We fully respect your right to privacy and guarantee that your data will never be used for commercial purposes.

Description

Description

Processing times

- Standard 5 working days

- Urgent 2 working days

Description

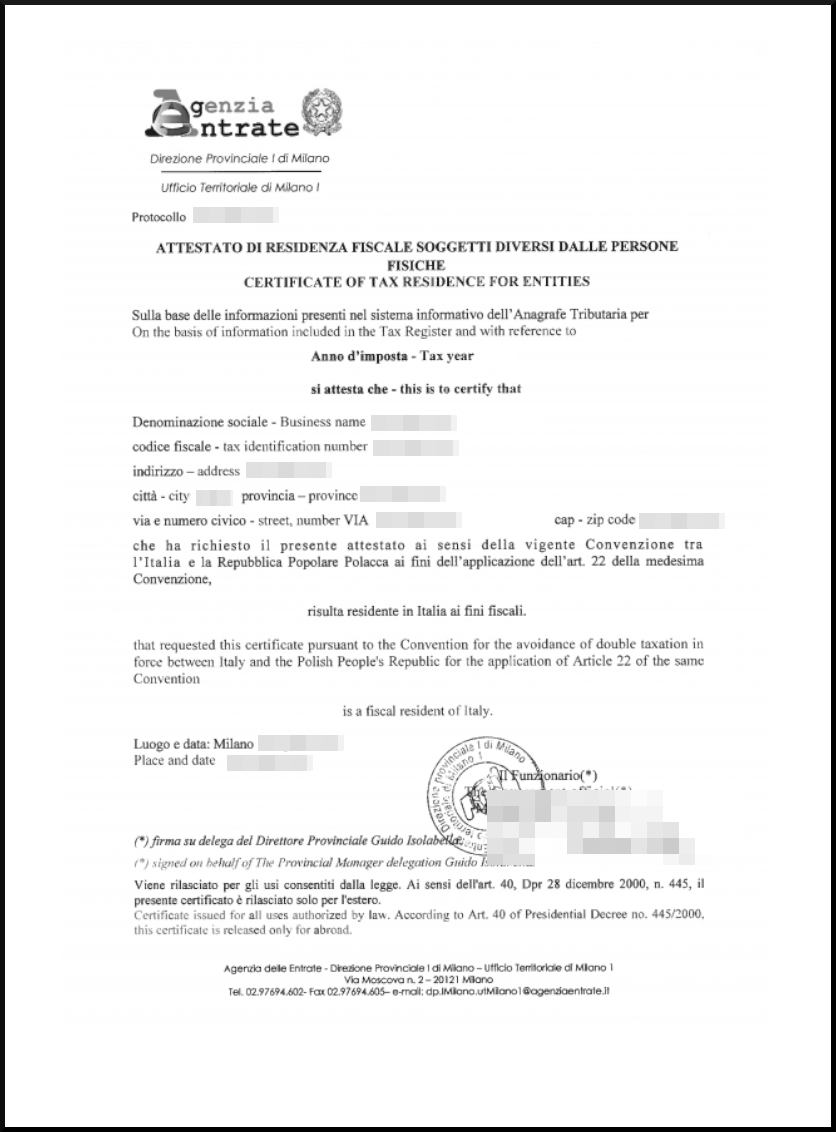

The Tax Residency Certificate is a document issued by the Revenue Agency which indicates the country in which the individual (individual or company) declares their income and pays the related taxes. In Italy, the tax residence of a citizen is recognized if the person has spent at least 183 days of the year in the country, if he or she is registered in the residents' registry and if he or she has established his or her tax domicile in Italy.

There are two types of certificate: the one with stamp duty and the one on plain paper. Here are the differences:

- Stamped certificate: This type of certificate has legal certification value. It is used for official purposes and guarantees the authenticity of the data.

- Plain paper certificate: This certificate has informational value only. It is issued on plain paper and has no legal validity.

Payment & Security

Payment methods

Your payment information is processed securely. We do not store credit card details nor have access to your credit card information.